Nikada

Expensive Companion,

All through the final yr, we continued changing slower-growth corporations with sturdy, faster-growing corporations in briefly depressed sectors and recognized comparable alternatives in new industries. These corporations align with our longer-term development themes of consolidation, pressured promoting of loans, transaction processing, reasonably priced housing finance and housing development We’ve recognized and are analyzing alternatives within the following industries: specialised development, pure useful resource royalties, distributors, logistics corporations, housing, and specialty finance. New investments have a mixed anticipated development charge (return on fairness (RoE) * (1-payout ratio)) plus earnings yield of no less than 30 to 40%, a metric of deep worth incorporating development.

As we proceed so as to add faster-growing sturdy corporations to the portfolio, I consider we have now the highest- high quality companies within the fund’s historical past, with a reduction that continues to persist because the market fails to comprehend the development in our corporations’ positions. I consider top quality is mirrored in free money movement development with extremely recurring revenues (similar to in subscription companies), excessive free money movement conversion, and returns on fairness which can be greater than less-risky options, similar to well-underwritten debt which at present has yields within the low-teens.

The Bonhoeffer Fund returned a achieve of 11.3% internet of charges within the third quarter of 2024. In the identical time interval, the MSCI World ex-US, a broad-based index, returned 7.7%, and the DFA Worldwide Small Cap Worth Fund, our closest benchmark, returned 8.5%. As of September 30, 2024, our securities have a weighted common earnings/free money movement yield of 12.5% and a mean EV/EBITDA of 4.6.

The present Bonhoeffer portfolio has projected earnings/free money movement development of about 12.5%. The DFA Worldwide Small Cap Worth Fund had a mean earnings yield of 11.6% with 8.2% development. Bonhoeffer Fund’s and the indexes’ multiples are barely greater than the earlier quarter, primarily as a consequence of share value will increase.

Bonhoeffer Fund Portfolio Overview

Bonhoeffer’s funding portfolio consists of deep value-oriented particular conditions, in addition to growth- oriented corporations that may compound worth over time and have been bought at an inexpensive value. Generally, we’re paying not more than mid-single digit multiples of 5 yr ahead incomes per share (‘EPS’). We’re significantly desirous about corporations in market niches that develop organically and/or by means of transition or consolidation. We additionally wish to see lively capital allocation by means of opportunistic buybacks, natural development and synergistic acquisitions. And importantly, we wish to see sturdiness, as measured by growing recurring revenues, excessive free money movement conversion and constant and rising RoEs in our portfolio corporations. There have been modest modifications inside the portfolio within the third quarter, that are according to our low historic turnover charges. We offered a few of our slower-growing investments that aren’t shopping for again their inventory and invested a few of our money into area of interest rising banks, like FFB Bancorp (OTCQX:FFBB), Northeast Bancorp (NECB), described within the case examine under, Residents Banks, Mission Financial institution (OTCPK:MSBC) and United Bancorp of Alabama (OTCQX:UBAB).

As of September 30, 2024, our largest nation exposures included: United States, United Kingdom, South Korea, Canada, Latin America, and Philippines. The most important {industry} exposures included: distribution, actual property/infrastructure/finance, telecom/media, and client merchandise.

At this cut-off date, it’s applicable to tell apart between the portion of your portfolio that’s newer and is comprised of upper development fairness alternatives versus the legacy portion comprised of slower development particular scenario equities that we have now been describing within the earlier quarterly letters. About 80% of the portfolio is invested in new greater development equities and 20% is invested in legacy slower development deep worth equities. The remaining decrease development corporations within the portfolio have thesis which can be enjoying out similar to Millicom (TIGO). The year-to-date efficiency of the upper development equites is larger (23% on common) than the legacy slower development deep worth equities (-6% on common).

Conclusion

As all the time, if you want to debate any of the funding frameworks or particular investments in deeper element, then please don’t hesitate to achieve out. As we wrap up the fourth quarter, I want you and your loved ones a blessed Vacation Season and need to thanks in your continued confidence in our work.

Heat Regards,

Keith D. Smith, CFA

INVESTMENT THEMES Compound Mispricings (14% of Portfolio; Quarterly Efficiency 2.2%)

Our Korean most well-liked shares, Asian actual property and Vistry (OTCPK:BVHMF) all function traits of compound mispricings. The thesis for the closing of the voting, nonvoting, holding firm and a number of enterprise valuation hole contains proof of higher governance and liquidity and the decline or sale of the legacy enterprise. We’re additionally in search of company actions similar to spinoffs, gross sales, share buybacks, or holding firm transactions and general money movement development.

Our Lotte Chilsung Most popular holding is a compound mispricing as it’s the popular inventory of the underlying enterprise. The popular/widespread low cost is at present about 44%. The popular has the identical declare to the underlying asset of Lotte Chilsung because the widespread, but it surely receives a better dividend and doesn’t have a vote. Lotte Chilsung can be a compound mispricing as its major holdings embrace beverage and liquor corporations and owns an undeveloped plot of land within the Gangnam district of downtown Seoul .

Lotte Chilsung is the most important beverage agency in South Korea, . offering alcoholic drinks in addition to Pepsi merchandise in Pakistan, the Philippines and Myanmar. Lotte Chilsung is managed by the Shin household. In 2017, the Lotte chaebol, a Korean household holding firm, was restructured into working subsidiaries with the cross-holdings of those subsidiaries aggregated into a brand new holding firm, Lotte Company. Because of this restructuring, Lotte Chilsung retained the beverage companies in addition to the land in downtown Seoul. For the reason that restructuring, Lotte Chilsung has improved investor relations and lately gained investor relations awards. Lotte Chilsung holds Gangnum land in downtown Seoul whose estimated worth ranges from ₩1.9 trillion to ₩3.8 trillion. A number of the different Lotte subsidiaries require money to pay down debt. One solution to increase money is to promote the land and distribute the proceeds to pay down the non- Chilsung subsidiary debt. This could end in a dividend to Lotte Chilsung shareholders together with the Shin household to pay down the non-Chilsung debt.

Lotte Chilsung at present generates RoEs within the low teenagers (the mid teenagers if the actual property is excluded). Primarily based upon Lotte Chilsung’s Worth-Up plan, they anticipated to generate a RoE of 15% by 2028. Administration expects to extend gross sales by 11% yearly and its working revenue to double by 2028. Primarily based upon Lotte Chilsung’s present inventory value, assuming the Seoul land has no worth, Lotte Chilsung widespread is promoting for 6x 4-yr ahead EPS and the popular inventory is promoting for 3x 4-yr ahead EPS.

Lotte Chilsung is an efficient enterprise operationally and is in an excellent place to develop. The most important disadvantage at this level is the shrinking home market dimension of client merchandise similar to drinks. This shrinkage has been greater than offset by new merchandise and development abroad over the previous three years with income rising by 12% yearly. Administration expects income to develop by 11% per yr for the following 4 years.

Given these elements, earnings are anticipated to develop by greater than 15% over the following 4 years. This development charge together with its modest ahead valuation (3-6x earnings) ought to result in anticipated returns of excessive teenagers to low twenties going ahead.

Under is our present valuation of Lotte Chilsung:

Lotte Chilsung (♖bn)

EBITDA

A number of

Worth

% of Worth

Beverage & Liquor Ops

₩453

8.2

₩3,728

66%

Gangnum Actual Property

₩1,900

33%

50% of sale worth

₩3800 b worth

Lotte Akhtar Beverage

₩48

1%

52% of Akhar Beverage (October 2018)

Money

₩242

3/2024 money

Debt

-₩1,617

3/2024 debt

Valuation (₩bn)

NI (₩bn)

₩3,441

100%

Maintain co Disc

20%

Shares (m)

₩138

10.054300

Worth Per Share

₩13,725

NI Mult

♖342,214

Low cost

Frequent Shares

8.8

₩121,200

-64.6%

182%

Tang BV

₩930

Ex Actual Esate

Most popular Shares

5.0

₩68,300

-75.0%

301%

BV/Share

₩92,488

RoTE ex RE

14.8%

EBITDA A number of

Upside*

Tang BV

7

♖297,931

293%

PP&E

₩2,670

8

♖333,976

340%

NWC

₩322

9

♖370,020

388%

Debt

₩1,617

10

♖406,064

435%

Tang BV

₩1,375

BV/Share

₩136,757

RoTE

10.0%

* Most popular upside assuming most well-liked 90% of widespread inventory

EBITDA Multiples

Korean Alcohol Comps

6.2

Hite Jinro & Muhak

6.2

Worldwide Beverage Bottlers

10.3

Coca-Cola Cons, Coca-Cola Europacific, Coca-Cola FEMSA, Coca Cola Amatil, Arca Continental,

Icecek Cola-Cola, Coca-Cola HBC

11.1

15.3

8.3

14.9

7.9

5.3

9

Click on to enlarge Public Leverage Buyouts (LBOs) (42.3% of Portfolio; Quarterly Efficiency 12.4%)

Our broadcast TV franchises, leasing, constructing merchandise distributors and dealerships and repair outsourcing, fall into this class. One development we discover significantly compelling in these corporations is development creation by means of acquisitions, which gives synergies and operational leverage related to vertical and horizontal consolidation. The elevated money movement from acquisitions and subsequent synergies are used to repay the debt and repurchase inventory, and the method is repeated. This technique’s effectiveness relies upon a diffusion between borrowing, rates of interest and the money returns from the core enterprise and acquisitions. Over the previous few months, long-term rates of interest have been declining and short-term charges are anticipated to observe so a big and rising unfold is on the market to corporations, like North American Building (NOA) who’ve a excessive return on capital. One solution to measure future anticipated returns are post-synergy money movement ratios paid for acquisitions. One other solution to measure future development in anticipated returns is thru incremental return on incremental invested capital (RoIIC).

A lot of our holdings used the acquisition/buyback mannequin described above. A few of these corporations have additionally used modest leverage to amplify the returns of fairness to twenty% and above, over the previous 5 to 10 years from the acquisition/buyback mannequin. These corporations embrace: Terravest (OTCPK:TRRVF), Asbury Vehicle (ABG), Ashtead (OTCPK:ASHTF), Autohellas (OTCPK:AOHLF), Builders First Supply (BLDR) and NOA. As well as, many of those corporations are shopping for again inventory and the modest present valuations make these buybacks accretive

NOA is an instance of an attention-grabbing public leveraged buyout (“LBO”). NOA is exclusive amongst different dust transferring providers corporations in that it focuses on maximizing gear utilization throughout its initiatives. Dust transferring providers companies present providers to mining and development providers corporations world wide. Lots of the mining and development providers corporations are fragmented and function in hostile climate places. These corporations can have extra pricing energy in hostile climate places in comparison with the extra temperate climate places, thus offering these providers in additional hostile environments generate greater gross margins than different dust transferring providers corporations. One solution to calculate RoIIC, is to divide the modifications in cashflow from operations (‘CFO’) by the capital expenditure and merger and acquisition funding over a given time period. Under is the calculation of the RoIIC over the previous 10 years.

As may be seen from the RoIIC evaluation, NOA’s RoE and RoIIC has elevated over the previous 5 to 10 years. The current MacKellar acquisition will additional improve NOA’s RoE. Under is an up to date 5-yr DCF valuation for NOA:

NOA (CD$, hundreds of thousands)

New CEO

Three

Mac Kellar

5-yr trailing

Acquistions

Acquisition

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

19.1%

Capital Invested

47.7

27.1

19.5

-4.7

10.5

31.5

196.4

152.9

114.5

108.1

113.9

240

220

685.8

2-yr sum

46.6

14.8

5.8

42

227.9

349.3

267.4

222.6

222

353.9

4-yr sum

52.4

56.8

233.7

391.3

495.3

571.9

489.4

576.5

CFO

0.2

77.7

48.73

37.4

45.6

56.8

95.2

149.4

155

164.5

187.5

219

350

130.7

2yr change

48.53

-40.3

-3.13

19.4

49.6

92.6

59.8

15.1

32.5

54.5

4yr change

45.4

-20.9

46.47

112

109.4

107.7

92.3

69.6

5-yr avg

2-yr ROIIC

104.1%

-272.3%

-54.0%

46.2%

21.8%

26.5%

22.4%

6.8%

14.6%

15.4%

17.1%

4-yr ROIIC

86.6%

-36.8%

19.9%

28.6%

22.1%

18.8%

18.9%

12.1%

20.1%

Internet Earnings

-13.7

69.2

-1.2

-7.5

-0.5

5.3

15.3

37.1

49.2

51.4

67.3

63.1

120.15

Fairness

132.6

191.8

189.6

171.6

159

145.9

150.2

180.1

248.5

278.5

305.9

357

402.4

Return on Fairness

-10.3%

36.1%

-0.6%

-4.4%

-0.3%

3.6%

10.2%

20.6%

19.8%

18.5%

22.0%

17.7%

29.9%

Click on to enlarge

The important thing assumptions on this DCF embrace a decline to {industry} development charge after the MacKellar acquisition is built-in into NOA in 2025, a gradual working margin after 2025, and a 5% of market cap buyback as soon as NOA’s leverage goal is achieved in 2025. The 5% buyback represents 40% of projected revenue. These assumptions end in an higher teenagers EPS development charge over the following 5 years, an $85 per share worth and a 23% IRR.

Distribution (51.6% of Portfolio; Quarterly Efficiency 13.8%)

Our holdings in automotive dealerships and branded capital gear dealerships, constructing product distributors and electrical element distributors corporations all fall into the distribution theme. One of many primary key efficiency indicators for dealerships is velocity, or stock turns. We personal a number of the highest-velocity distributors in markets world wide.

In our Q1 2024 letter, our case examine was our digital element distributor, Arrow Electronics (ARW). Arrow’s mannequin is to modestly develop earnings (5-6% per yr) and buyback inventory at a charge of about 10%. Under is the up to date RoIIC mannequin for Arrow:

Arrow (US$, Hundreds of thousands)

3-yr common

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024 (E)

101.3%

Capital Invested

484.1

285.4

666

228.8

183.2

449.4

163.9

124.3

60.9

78.8

83.3

89

436.3

2-yr sum

769.5

951.4

894.8

412

632.6

613.3

288.2

185.2

139.7

162.1

172.3

4-yr sum

1664.3

1363.4

1527.4

1025.3

920.8

798.5

427.9

347.3

312

CFO

622.8

718.6

711.2

748.7

750.9

986.4

722

848

1358.6

1651.2

1041.8

1092

441.9

2yr change

88.4

30.1

39.7

237.7

-28.9

-138.4

636.6

803.2

-316.8

-559.2

4yr change

128.1

267.8

10.8

99.3

607.7

664.8

319.8

244

5-yr avg

2-yr ROIIC

0.0%

9.3%

3.4%

9.6%

37.6%

-4.7%

-48.0%

343.7%

574.9%

-195.4%

-324.6%

70.1%

4-yr ROIIC

9.4%

17.5%

1.1%

10.8%

76.1%

155.4%

92.1%

78.2%

82.5%

Fairness

4185

4159

4195

4466

4998

5376

4866

5149

5341

5611

5877

5878

RoE

1.4%

10.4%

0.2%

13.8%

11.7%

9.1%

12.2%

14.1%

24.3%

28.0%

16.3%

17.1%

19.9%

Click on to enlarge

Given the cyclicality of Arrow’s earnings, it’s higher to take a look at the long run common RoIICs and averages. On this case, the 5-yr common FCF/Fairness is 20% and 4-year RoIIC is 83%. As to ahead estimates of development and earnings under is the present estimated development to 2029 with declining development after 2026. This ends in a 5-year development charge of 20% per the previous 5-year development charge and better than the 10-year development charge. The rationale for the upper development charge than the 10-year development charge is will increase in element demand from AI and web of issues. If the previous is repeated into the long run, the EPS development charge will probably be within the low teenagers. Under is an up to date 5-year DCF for Arrow Electronics:

Arrow (US$, Hundreds of thousands)

EPS Development

19.7%

2021

2022

2023

2024

2025

2026

2027

2028

2029

$ 120.00

3.61

5-yr fwd PE

5% development PE

20.6%

8.88

Earnings/FCF Yield

18.5

Revs

$34,477

$37,124

$33,107

$27,655

$28,178

$30,996

$34,000

$37,000

$38,500

8%

-11%

-16%

2%

10%

10%

9%

4%

6% natural development

2% Operation Lev

NI

$1,137

$1,465

$977

$620

$780

$930

$1,054

$1,130

$1,271

9% Repurchase

Future SP

$615.81

3.3%

3.9%

3.0%

2.0%

2.3%

3.0%

3.1%

3.2%

3.3%

17% Complete EPS development

IRR

39%

EPS

$16.70

$24.70

$13.52

$12.52

$17.31

$22.68

$28.25

$33.29

$41.13

48%

-45%

-7%

38%

31%

25%

18%

24%

Historical past

EPS GR Price

Buyback

5

19%

9% /yr

68.1

59.3

54.4

49.5

45.0

41.0

37.3

33.9

30.9

10

14%

Click on to enlarge

Within the elevated demand from AI and web of issues case, as proven above, the 2028 EPS will rise to $33 per share. If the previous case repeats, the 2028 EPS will rise to $26 per share. With these development charges, multiples ought to improve to 15x from the present a number of of about 10x. This ends in a worth vary of about $400/share to $500/share vary and an IRR vary of 27% to 33%.

Telecom/Transaction Processing (13.7% of Portfolio; Quarterly Efficiency -8.4%)

The growing use of transaction processing within the markets of our respective corporations, in addition to the rollout of fiberoptic and 5G networks is offering development alternatives inside this theme. Given that the majority of those corporations are holding corporations and have a number of elements of worth (together with actual property), the timeline for realization could also be longer than for extra mono-industry-focused corporations.

Millicom (TIGO) is one the remaining telecom corporations within the portfolio as the corporate retains favorable market situations together with working in lots of two participant markets or in markets the place the variety of members is getting smaller. With fewer gamers, telco corporations can get better pricing energy to offset the growing price of community development and operations. In one in all its key markets, Columbia, a big participant has entered chapter which can cut back the variety of market gamers. As well as, Millicom is in negotiations to purchase the belongings of this agency out of chapter.

The sale of Lati, Millicom’s tower spin-off, has been introduced with SBA Communications. The inventory value has not moved considerably because the tower sale. Millicom continues to implement price cuts recognized by the brand new CEO and crew that was put in place by the brand new massive shareholder, Xavier Niel. Xavier has executed tender provides for Millicom shares (the newest of which was at $25.75 per share) which has elevated his stake in Millicom to 40%. Given Mr. Niel’s curiosity in buying 100% of TIGO, I really feel the upside is capped, so we have now offered a part of our place for higher alternatives.

Client Product (7.0% of Portfolio; Quarterly Efficiency 4.2%)

Our client product retailing, tire, and beverage corporations comprise this class. The defensive nature of those corporations can result in better-than-average efficiency. One theme we have now been analyzing is the event of category-killer retail franchises. These corporations have developed native franchises which have greater stock turns, margins, and gross sales per sq. foot than rivals. These elements resulted in nice unit economics and excessive returns on incremental invested capital. Additionally they have some distinctive traits, together with specialty niches (similar to tire shops or athletic sneakers) or providing one thing the rivals won’t do (similar to promoting searching provides).

Actual Property/Building/Finance (51.6% of Portfolio; Quarterly Efficiency 11.1%)

The present development holdings (in US and Europe by means of Builders First Supply and Vistry, respectively) ought to do effectively as governments worldwide incentivize infrastructure packages and new development continues to replenish the housing deficit within the US and the UK. Financing of low-income actual property improvement in addition to development in small enterprise lending (through small enterprise administration (“SBA”)) and the buying of pressured sale loans from mergers and acquisition in addition to the FDIC are themes driving development in our financial institution holdings, FFB Bancorp (OTCQX:FFBB, “FFB”), United Bancorp of Alabama (OTCQX:UBAB) and Northeast Financial institution (NBN, “NB”). We’re in search of banks with sustainable RoEs and EPS development charges greater than about 20% which can be promoting for single digit multiples and have respectable underwriting. We proceed to search out banks that meet these standards.

NEW PORTFOLIO IDEAS Analysis of corporations utilizing Returns on Incremental Invested Capital

In previous letters, we have now used a RoIIC evaluation to estimate the incremental returns that corporations are producing from invested capital. The idea for RoIIC evaluation is measuring the return. On this case the modifications in working capital adjusted money movement from operations, divided by the incremental funding, capital expenditures much less disposals plus acquisitions much less disposals. RoIIC utilized in mixture with RoIC gives an instance of how environment friendly corporations are using capital and the developments in that effectivity. I’m in search of excessive teenagers to low twenties RoIIC’s as funding candidates, particularly in conditions the place the enterprise mannequin is bettering or altering from the previous. Examples of this evaluation is proven above for NOA and Arrow Electronics.

For monetary corporations, return on incremental fairness capital (RoIEC), the web revenue return related to an extra greenback of fairness funding, is extra relevant as fairness is the important thing measure of incremental capital. The return is measured by adjusted internet revenue and the funding by widespread fairness. Since fairness is monitored by regulators and most banks maintain a buffer of fairness above regulatory ranges, that is an applicable solution to measure funding. An instance of the RoIEC evaluation for FFB Bancorp is proven under.

FFB Bancorp ($US, Hundreds of thousands)

3-yr common

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

20.2%

Fairness (AO

23.184

24.045

26.367

29.758

34.458

41.344

51.7

62.65

85.233

96.26

158.3

Capital Invested

0.861

2.322

3.391

4.7

6.886

10.356

10.95

22.583

11.027

62.04

116.956

2-yr sum

0.861

3.183

5.713

8.091

11.586

17.242

21.306

33.533

33.61

73.067

4-yr sum

6.574

11.274

17.299

25.333

32.892

50.775

54.916

106.6

NI

-0.297

1.705

2.172

3.072

3.561

6.264

9.194

11.45

20.23

26.82

36.66

23.6

2yr change

2.469

1.367

1.389

3.192

5.633

5.186

11.036

15.37

16.43

4yr change

3.858

4.559

7.022

8.378

16.669

20.556

27.466

5-yr avg

2-yr ROIEC

0.0%

77.6%

23.9%

17.2%

27.6%

32.7%

24.3%

32.9%

45.7%

22.5%

31.6%

4-yr ROIEC

0.0%

34.2%

26.4%

27.7%

25.5%

32.8%

37.4%

25.8%

29.8%

Fairness

23.184

24.045

26.367

29.758

34.458

41.344

51.7

62.65

85.233

96.26

158.3

RoE

-1.3%

7.1%

8.2%

10.3%

10.3%

15.2%

17.8%

18.3%

23.7%

27.9%

23.2%

22.2%

Click on to enlarge

The ROIEC for FFBB is about 30% which is driving the RoE to the higher 20% at present and will drive the RoE to 30% over time.

Returns to Our Development Technique versus Legacy Deep Worth Strategy

Since we have now been changing legacy sluggish development deep worth shares with fairly priced quicker rising shares, the efficiency of the expansion shares has outpaced the legacy deep worth shares. About three years in the past, I started to query if deep worth was one of the best ways to acquire our goal returns of 15% for the fund. As a number of the deep worth performs didn’t play out as anticipated, we changed these corporations with greater development corporations. There are just a few legacy deep worth performs that proceed to play out, similar to Millicom, so they are going to be retained till they play out or different recognized shares present higher alternatives. Presently, the portfolio is 80% quicker development and 20% deep worth. Equities within the quicker development portion of the portfolio have outperformed the legacy deep worth portfolio over the previous yr. The typical efficiency of the quicker development group was 23% yr thus far whereas the common efficiency for the deep worth group was -6% yr thus far.

CASE STUDY: NORTHEAST BANK (NBN)

Northeast Financial institution (“NBN”) is a group financial institution situated in Maine that gives banking service to small and mid-sized companies (“SMEs”) in Maine, SBA loans nationwide and purchases and providers orphan loans. Orphan loans are loans that are offered by both the FTC, because of pressured gross sales related to mergers, or the FDIC, because of pressured gross sales from insolvency. NBN operates out of its headquarters in Portland, Maine, an workplace in Lewiston, Maine, an workplace in Boston, Massachusetts and 7 department places throughout Maine. NBN’s technique contains buying orphan loans in addition to originating specialty loans similar to PPP loans throughout COVID or SBA loans at present. NBN additionally has specialised mortgage buy group, Nationwide Lending Group (NLG) that purchases and providers orphan loans. The orphan loans crew has over 30 years of expertise in originating and servicing FTC and FDIC offered loans. A lot of the NLG’s present administration crew labored for Capital Crossing Financial institution that was based by NBN’s CEO and President Richard Wayne within the late Eighties to buy orphan loans. Capital Crossing was offered to Lehman Brothers in 2007. As a public firm, Capital Crossing generated over 20% annualized returns from the IPO to sale. After the monetary disaster, Richard Wayne was in a position to reassemble the Capital Crossing crew as NBN, after he gained management of the corporate in 2010. Different banks which have grown through shopping for orphan loans embrace Beal Financial institution and First Residents whose present or peak dimension is multiples of NBN’s present dimension illustrating respectable development potential for NBN.

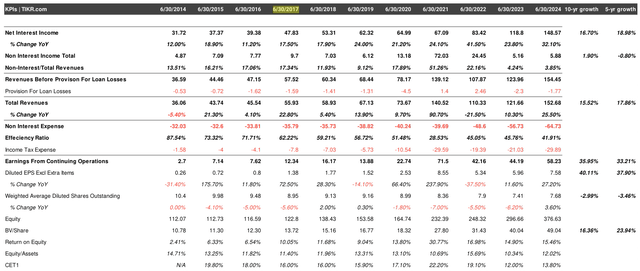

NBN has grown EPS by nearly 40% per yr over the previous 5 and ten years. This development is pushed by opportunistically shopping for orphan loans and originating PPP loans throughout COVID and SBA loans at present. NBN’s lending franchise and mortgage buy generates a mean mortgage yield of 8.9% and has organically grown loans by 26% per yr over the previous 5 years. The incremental mortgage yield is estimated by administration to be 8.8%. The sturdy mortgage development is comprised of criticized plus watch record loans of 1.4%, non-performing loans (“NPAs”) of 0.9% and a mortgage loss reserve to NPAs of 118%. NBN funds its loans by means of CDs and generates a excessive price of funds of 4.0%. The ensuing internet curiosity margin (‘NIM’) is 4.9% and is sustainable as funding prices will decline with declining mortgage yields. NBN’s largest shareholder is its administration, which holds 15% of its widespread inventory.

NBN was based in 1872 in Portland, Maine to offer banking providers to the Maine area. From 2002 to 2010 (earlier than Mr. Wayne’s arrival), NBN’s guide worth elevated by 4% per yr. In 2010, Richard Wayne, joined NBN, contributing his expertise in shopping for orphan loans because the founder and CEO of Capital Crossing Financial institution. Shortly after Mr. Wayne’s arrival, NBN started buying orphan loans. From 2010 to 2023, NBN’s guide worth elevated by 7% per yr and EPS grew by 21% per yr.

NBN has traditionally repurchased shares when it couldn’t originate or buy loans for its hurdle charge of return. From June 2020 to June 2023, NBN repurchased shares at a charge of 6.3% per yr. Since June 2023, NBN has discovered greater return bought or originated loans and has needed to challenge fairness to fund this development.

NBN’s platform not solely provides a nationwide footprint but additionally new service optionality together with PPP loans and SBA loans. At its present charge of SBA mortgage manufacturing, NBN would be the largest SBA mortgage producer in the US at $1.45 billion/yr. NBN can promote 80% of those SBA loans (the federal government assured portion) at a 10-15% premium into the market, thus returning 90% of mortgage stability to fund additional SBA loans. NBN has partnered with an SBA servicer, Newity LLC, to service the loans NBN originates.

A financial institution productiveness measure is the effectivity ratio, non-interest expense divided by whole revenues. An excellent benchmark for effectivity is a 50% effectivity ratio. The typical effectivity ratio for business banks in Q1 2024 was 59%. NBN’s effectivity ratio is 41% for the trailing 5 quarters ending Q1 2025. Given the variety of non-interest bearing providers it is a good ratio.

NBN has generated 14% to 31% returns on fairness over the previous 5 years. This has been a rise from the 6 to 12% vary within the earlier 5 yr interval. The power to generate these returns is the results of elevated effectivity, originating PPP and SBA loans and shopping for orphan loans. Under is a RoIIC evaluation for NBN:

Northeast Bancorp ($US, Hundreds of thousands)

PPP

loans

3-yr common

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

15.2%

Fairness

110.82

113.54

116.403

123.748

139.984

153.623

163.82

232.213

249.807

298.455

377.628

Capital Invested

2.72

2.863

7.345

16.236

13.639

10.197

68.393

17.594

48.648

79.173

224.005

2-yr sum

2.72

5.583

10.208

23.581

29.875

23.836

78.59

85.987

66.242

127.821

4-yr sum

12.928

29.164

40.083

47.417

108.465

109.823

144.832

213.808

NI

2.69

7.14

7.62

12.34

16.17

13.88

22.74

71.5

42.2

44.2

58.3

34.1

2yr change

4.93

5.2

8.55

1.54

6.57

57.62

19.46

-27.3

16.1

4yr change

13.48

6.74

15.12

59.16

26.03

30.32

35.56

5-yr avg

2-yr ROIEC

0.0%

88.3%

50.9%

36.3%

5.2%

27.6%

73.3%

22.6%

-41.2%

12.6%

19.0%

4-yr ROIEC

46.2%

16.8%

31.9%

54.5%

23.7%

20.9%

16.6%

29.5%

Fairness

110.82

113.54

116.403

123.748

139.984

153.623

163.82

232.213

249.807

298.455

377.628

RoE

2.4%

6.3%

6.5%

10.0%

11.6%

9.0%

13.9%

30.8%

16.9%

14.8%

15.4%

18.4%

Click on to enlarge

NBN has 4 levers for earnings development: 1) efficiently bidding and profitable orphan mortgage gross sales; 2) new providers similar to sponsor loans, PPP loans and SBA loans; 3) elevated effectivity; and 4) distributing extra money by shopping for again shares.

NBN has economies of scale within the service markets it at present or traditionally competed in (PPP and SBA loans). Additionally they have scale primarily based upon the amount of the loans they buy and originate; in order they develop, they need to turn out to be extra environment friendly.

Nationwide Orphan Mortgage and SBA Mortgage Companies Market

NBN competes within the SBA and the FDIC and FTC mortgage sale markets throughout the US. NBN focuses on the smaller finish of the orphan and SBA loans markets, the place debt funds and bigger banks haven’t got the overhead constructions to successfully compete.

For the yr interval ending September 30, 2024, the SBA origination market dimension was $31.1 billion. Over the previous 5 years the market grew by 6% per yr. For the present fiscal yr, NBN is the fifth largest SBA originator with 4.4% of the market. The highest 5 originators have about 30% of the market.

FTC gross sales are pushed by financial institution merger and acquisition exercise. Based on the S&P, the quantity and dimension of financial institution acquisitions have declined over the previous 5 years from 253 offers with $30 billion in belongings in 2018 to 100 offers with $4 billion in belongings in 2023. That is partially as a result of extra restrictive FTC insurance policies of the Biden administration. With Trump profitable the 2024 election, the expectation is that the FTC will enable extra mergers and acquisitions than below the Biden administration. The elevated degree of mergers and acquisitions ought to end in extra orphan loans in overlapping footprints of merging banks.

FDIC gross sales are the results of financial institution failures. Whereas the precise timing and magnitude of financial institution failures will not be predictable upfront, over the previous 20 years, there have been important failures from 2008 to 2011 and in 2023. The timing of the orphan loans is aperiodic and might occur rapidly because of financial institution runs (in 2023) or over time because of credit score points (from 2008 to 2011). In consequence, FTC pressured gross sales of loans are a extra recurring supply of orphan loans than financial institution failure FDIC sale of loans.

Draw back Safety

NBN’s dangers embrace each operational leverage and monetary leverage. Operational leverage relies upon the fastened vs. variable prices of the operations. There are economies of scale associated to some capabilities similar to transaction and mortgage processing and cross-selling of banking providers.

Monetary leverage may be measured by the fairness/belongings and CET1 ratios. NBN has greater fairness/belongings of 12.0% and CET1 of 13.8% than different area of interest lenders (like United Bancorp of Alabama, Retailers Financial institution of Indiana and FFB Bancorp). The historic monetary efficiency for NBN is illustrated under.

Administration and Incentives

NBN’s administration crew has developed a mortgage buy and origination engine together with new providers and an operationally environment friendly agency offering monetary providers.

The bottom compensation for the administration crew (high 5 officers) ranges from $3.2 million per yr for the President/CEO to $762,000 per yr for the Chief Retail Banking Officer. Over the previous yr, the highest three administration people whole compensation was about $8.2 million per yr, about 14% of internet revenue per yr. The CEO at present maintain 733,437 shares and choices (value $73.3 million), which is greater than 9 instances his 2023 wage and bonuses. The CEO’s compensation is structured to incorporate a $655,000 base pay $391,000 in money bonus compensation and $1.2 million in performance-based inventory compensation. The precise metrics for the money bonus is 70% primarily based upon pre-tax internet revenue targets and 30% primarily based upon qualitative standards decided by the Board of Administrators. No money bonus will probably be paid if the pre-tax revenue is 20% under the pre-tax revenue goal. The performance-based inventory bonus relies upon attaining a three-year common 1.75% return on belongings goal. If the three-year common is lower than 70%, then no efficiency bonus is earned.

Board members have a big funding in NBN. The board and administration owns 1,192,179 shares, about 14.5% of shares excellent ($119 million). Inventory grants offered to administration and workers have been equal to 1.8% per yr of the shares excellent over the previous two years.

Valuation

Northeast Financial institution

Senstitivity Desk

Worth

Upside

Present Adjusted Earnings

$9.69

7-year Anticipated EPS Development Price

20%

1.9%

$100.49

0.0%

Historic EPS Development Price

40%

10.0%

$233.68

132.5%

Present AAA Bond Price

5.2%

Development Price

15.0%

$315.67

214.1%

Implied Graham Mutiplier **

41.04

18.0%

$364.87

263.1%

Implied Worth

$397.66

20.0%

$397.66

295.7%

Present Worth

$100.49

22.5%

$438.66

336.5%

* (2*Development Price + 8.5)

Click on to enlarge

The important thing to the valuation of NBN is the anticipated development charge. The present valuation implies an earnings/FCF improve of .9% in perpetuity utilizing the Graham method ((8.5 + 2g)). The historic 5-year earnings per share development has been 40% per yr and the 5-year common return on fairness of 18%.

A bottom-up evaluation primarily based upon NBN’s market development charges (US orphan mortgage and SBA mortgage markets) and historic development charges ends in an estimated 20% projected EPS development charge. Traditionally, NBN’s EPS development charge was 40% per yr pushed by new service choices and new buyer relationships over ten years. Utilizing a 20% anticipated development charge, the ensuing present a number of is 41x of earnings, whereas NBN trades at an earnings a number of of about 10x. If we use a 3% development charge, the implied a number of is 15x. If we apply 15x earnings to NBN’s present earnings of $9.69, then we arrive at a worth of $145 per share, which is an inexpensive short-term goal. If we use a 20% seven-year development charge, then we arrive at a worth of $400 per share. This ends in a five-year IRR of 32%.

Development Framework

Northeast Bancorp ($US, Hundreds of thousands)

EPS Development

24.9%

2022

2023

2024

2025

2026

2027

2028

2029

2030

$ 100.49

4.37

5-yr fwd PE

Development Financial institution PE

5.9%

10.28

Earnings/FCF Yield

15

Revs

$110,330

$121,660

$152,680

$190,850

$232,837

$279,404

$329,697

$382,449

$435,992

10%

25%

25%

22%

20%

18%

16%

14%

20% natural development (RoE)

0% Operation Lev

NI

$42,160

$44,190

$58,230

$72,788

$89,689

$108,703

$129,552

$151,783

$174,763

3% Repurchase

Future SP

$345.22

38.2%

36.3%

38.1%

38.1%

38.5%

38.9%

39.3%

39.7%

40.1%

23% Complete EPS development

IRR

28%

EPS

$5.34

$5.96

$7.58

$9.77

$12.41

$15.51

$19.05

$23.01

$27.32

12%

27%

29%

27%

25%

23%

21%

19%

Historical past

EPS GR Price

Buyback

5

38%

3% /yr

7900

7410

7680

7449.6

7226.1

7009.3

6799.0

6595.1

6397.2

10

40%

Click on to enlarge

One other means to take a look at development and the valuation of corporations is to estimate the EPS 5 years into the long run and see how a lot of right this moment’s value incorporates this development. We’re additionally assuming about 30% of internet revenue will probably be used for buy-backs, per the common 5-yr trailing buyback ranges. Utilizing the identical income described above ends in a 2028 EPS of $19.05, or 4.4x the present value. If we assume a development financial institution a number of of 15x, or $345 per share, decrease than the five-year-forward valuation above of $400 per share.

Comparables and Benchmarking

Under are the specialty banks corporations situated in the US. Most of NBN’s rivals are non-public banks. I’ve ranked the banks by anticipated return as calculated because the sum of the earnings yield plus the earnings development charge. In comparison with the specialty banks, NBN has one of many highest 5-year common RoE and TBV plus dividends development, price revenue/whole income and the bottom criticized mortgage quantities. The excessive CET permits NBN to return a lot of its generated money movement to traders through share buy-backs.

Identify

EPS Development

TBV + Div Development

Div Yield

5-yr Avg ROE

Payout

Development + Div

TAM

Alternate

Effectivity

CoF

NIM

Price/Tot Re

Mortgage Development

Buybacks

Mgmt Comp/

Mgmt

ESOP

CET

Criticized

LRR/NPA

EY

ER

TR/PE

Feedback

NI

Possession

UBAB*

31%

20.0%

1.3%

13.2%

10.0%

25.1%

OTCPK

47.0%

1.2%

4.5%

26.0%

15.0%

5/10%

4.5%

X

17.2%

5.0%

80.4%

13.6%

37.3%

340.2%

Low Earnings & AL/FL Seaside Lending, ECIP

MBIN

25%

27.0%

0.0%

23.0%

0.0%

23.0%

5x

NasdaqCM

33.7%

4.6%

3.0%

20.0%

38.0%

5.0%

39.7%

8.0%

3.3%

58.0%

14.1%

37.1%

323.9%

MF GSE Lending; Threat sharing

CWBK

12.7%

2.9%

19%/24%

15.0%

21.6%

OTCPK

50.0%

1.0%

4.1%

13.2%

11.5%

6.6%

18.6%

1.3%

262.8%

13.7%

35.3%

295.3%

SoCal RE Lending

CZBS*

27%

10.4%

1.1%

7.1%

15.0%

19.2%

OTCPK

51.0%

1.0%

4.9%

22.0%

8.0%

10.0%

42.5%

23.0%

3.6%

100.6%

14.6%

32.7%

280.5%

Low Earnings Lending, ECIP

FFBB

35%

24.0%

0.0%

25.0%

0.0%

25.0%

6x

OTCPK

47.0%

0.9%

5.2%

28.0%

25.0%

5.0%

7.0%

22.8%

X

19.0%

1.0%

151.3%

11.2%

36.2%

279.5%

CA & SBA Lending, Processing

NEWT

6.5%

21.0%

45.0%

18.1%

OTCPK

66.3%

6.6%

2.1%

92.7%

15.7%

12.3%

6.3%

16.1%

10.2%

101.5%

13.3%

24.8%

239.4%

MSBC

22%

16.6%

0.0%

18.7%/20%

0.0%

19.0%

5x

OTCPK

43.0%

1.1%

4.6%

7.0%

17.0%

53.0%

11.3%

0.7%

5201.0%

12.0%

31.0%

228.2%

CA Lending, Central/SoCal RE Lending

SCZC

1.9%

20.5%

10.0%

20.4%

OTCPK

42.0%

1.3%

5.2%

5.0%

24.0%

2.0%

6.6%

9.5%

12.5%

3.6%

357.0%

10.6%

29.1%

216.0%

CA Lending

NBN

36%

20.0%

0.1%

20.0%

1.0%

1G.G%

8x

NasdaqGM

42.0%

4.1%

5.1%

25.0%

24.0%

6.0%

14.0%

15.3%

13.2%

1.3%

G3.0%

10.4%

30.2%

206.2%

Pressured Promoting Loans; SBA Loans

Click on to enlarge Dangers

The first dangers are:

slower-than-expected market development as a consequence of slower than anticipated financial institution merger and acquisition exercise and/or financial institution failure charges; higher-than-expected effectivity ratios; and a scarcity of recent funding alternatives (SBA and orphan loans) and/or coupled with greater inventory costs making buybacks much less accretive. Potential Upside/Catalyst

The first catalysts are:

faster-than-expected SBA and/or orphan mortgage development as a consequence of higher-than-expected merger and acquisition exercise and/or financial institution failures; and better than anticipated effectivity ratios as a consequence of economies of scale. Timeline/Funding Horizon

The short-term goal is $145 per share, which is sort of 45% above right this moment’s inventory value. If the continued service development as a consequence of geographic growth performs out over the following 5 years (with a ensuing 20% earnings per yr development charge), then a worth of $373 (midpoint of the 2 strategies described above) may very well be realized. It is a 30% IRR over the following 5 years.

Disclaimer

This letter doesn’t include all the knowledge that’s materials to a potential investor within the Bonhoeffer Fund, L.P. (the “Fund”).

Not an Supply: The data set forth on this letter is being made out there to typically describe the philosophies of the Fund. The letter doesn’t represent a proposal, solicitation or suggestion to promote or a proposal to purchase any securities, funding merchandise or funding advisory providers. Such a proposal could solely be made to accredited traders via supply of a confidential non-public placement memorandum, or different comparable supplies that include an outline of fabric phrases referring to such funding. The data printed and the opinions expressed herein are offered for informational functions solely.

No Recommendation: Nothing contained herein constitutes monetary, authorized, tax, or different recommendation. The Fund makes no illustration that the knowledge and opinions expressed herein are correct, full or present. The data contained herein is present as of the date hereof however could turn out to be outdated or change.

Dangers: An funding within the Fund is speculative as a consequence of a wide range of dangers and concerns as detailed within the Confidential Non-public Placement Memorandum of the Fund, and this letter is certified in its entirety by the extra full data contained therein and within the associated subscription supplies.

No Advice: The point out of or reference to particular corporations, methods or devices on this letter shouldn’t be interpreted as a suggestion or opinion that it’s best to make any buy or sale or take part in any transaction.

Click on to enlarge

Unique Submit

Editor’s Observe: The abstract bullets for this text have been chosen by In search of Alpha editors.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.

Enterprise

Informasi mengenai king slot

king selot

king slot

king slot

kingselot

pg king slot

rungkad88

sabet88slot

sakti888

santai88

santika88

sebat777

sebat88

sensasi77

serba88

shangrila88

sheraton88

shopee88

sibukslot88

sido888

sinar88slot

sinartogel88

singa88

sis88

slotplay88

solitaire88

sontogel88

sparta888

speaker88

suara88

sukaslot888

sultan777

sumo7777

supermoney888

surga888

surgaplay88

surya888

suzuki88

tahta88

tahtatoto

target888

taruhan777

tato88

tebar88

teknis88

teluk88

teluk88

texas888

kilau88

tiket88

tiktok888

togelsumo88

totosaja88

trading88

tradingview88

tripadvisor88

uang88

ubud88

ultra77

usdt88

userslot88

uyatoto

vegasslot88

vertu777

voxy888

warung22

wasiat88

whatsapp88

winrate999

wks88

wordpress88

wuzz888

xuxu88

yoktogel88

zara88

adu88

agoda88

andara999

asiahoki777

asiahoki88

atlas777

atlas88

autospin888

axl77

axl777

ayo777

bakwanbet88

balak666

bangkit88

batu88

bayar777

bayar777

bayar88

berita88

bobo88

box77

bromo777

ceria88

cipit888

dewahoki88

dewanaga

dewanaga88

dewaslot77

dewi228

dewihoki88

dosen88

elanggame88

rungkad88 permainan paling high dan garansi imbal balik hasil besar bersama https://rungkad88.biz/

sabet88slot permainan paling high dan garansi imbal balik hasil besar bersama https://sabet88slot.com/

sakti888 permainan paling high dan garansi imbal balik hasil besar bersama https://sakti888.biz/

santai88 permainan paling high dan garansi imbal balik hasil besar bersama https://santai88.org/

santika88 permainan paling high dan garansi imbal balik hasil besar bersama https://santika88.org/

sebat777 permainan paling high dan garansi imbal balik hasil besar bersama https://sebat777.information/

sebat88 permainan paling high dan garansi imbal balik hasil besar bersama https://sebat88.information/

sensasi77 permainan paling high dan garansi imbal balik hasil besar bersama https://sensasi77.biz/

serba88 permainan paling high dan garansi imbal balik hasil besar bersama https://serba88.biz/

shangrila88 permainan paling high dan garansi imbal balik hasil besar bersama https://shangrila88.com/

sheraton88 permainan paling high dan garansi imbal balik hasil besar bersama https://sheraton88.com/

shopee88 permainan paling high dan garansi imbal balik hasil besar bersama https://shopee88.biz/

sibukslot88 permainan paling high dan garansi imbal balik hasil besar bersama https://sibukslot88.com/

sido888 permainan paling high dan garansi imbal balik hasil besar bersama https://sido888.com/

sinar88slot permainan paling high dan garansi imbal balik hasil besar bersama https://sinar88slot.information/

sinartogel88 permainan paling high dan garansi imbal balik hasil besar bersama https://sinartogel88.biz/

singa88 permainan paling high dan garansi imbal balik hasil besar bersama https://singa88.biz/

sis88 permainan paling high dan garansi imbal balik hasil besar bersama https://sis88.biz/

slotplay88 permainan paling high dan garansi imbal balik hasil besar bersama https://slotplay88.biz/

solitaire88 permainan paling high dan garansi imbal balik hasil besar bersama https://solitaire88.internet/

sontogel88 permainan paling high dan garansi imbal balik hasil besar bersama https://sontogel88.com/

sparta888 permainan paling high dan garansi imbal balik hasil besar bersama https://sparta888.co/

speaker88 permainan paling high dan garansi imbal balik hasil besar bersama https://speaker88.internet/

suara88 permainan paling high dan garansi imbal balik hasil besar bersama https://suara88.biz/

sukaslot888 permainan paling high dan garansi imbal balik hasil besar bersama https://sukaslot888.information/

sultan777 permainan paling high dan garansi imbal balik hasil besar bersama https://sultan777.asia/

sumo7777 permainan paling high dan garansi imbal balik hasil besar bersama https://sumo7777.com/

supermoney888 permainan paling high dan garansi imbal balik hasil besar bersama https://supermoney888.biz/

surga888 permainan paling high dan garansi imbal balik hasil besar bersama https://surga888.biz/

surgaplay88 permainan paling high dan garansi imbal balik hasil besar bersama https://surgaplay88.biz/

surya888 permainan paling high dan garansi imbal balik hasil besar bersama https://surya888.biz/

suzuki88 permainan paling high dan garansi imbal balik hasil besar bersama https://suzuki88.biz/

tahta88 permainan paling high dan garansi imbal balik hasil besar bersama https://tahta88.biz/

tahtatoto permainan paling high dan garansi imbal balik hasil besar bersama https://tahtatoto.biz/

target888 permainan paling high dan garansi imbal balik hasil besar bersama https://target888.biz/

taruhan777 permainan paling high dan garansi imbal balik hasil besar bersama https://taruhan777.biz/

tato88 permainan paling high dan garansi imbal balik hasil besar bersama https://tato88.org/

tebar88 permainan paling high dan garansi imbal balik hasil besar bersama https://tebar88.asia/

teknis88 permainan paling high dan garansi imbal balik hasil besar bersama https://teknis88.com/

teluk88 permainan paling high dan garansi imbal balik hasil besar bersama https://teluk88.biz/

teluk88 permainan paling high dan garansi imbal balik hasil besar bersama https://teluk88.information/

texas888 permainan paling high dan garansi imbal balik hasil besar bersama https://texas888.asia/

kilau88 permainan paling high dan garansi imbal balik hasil besar bersama https://texas888slot.org/

tiket88 permainan paling high dan garansi imbal balik hasil besar bersama https://tiket88.asia/

tiktok888 permainan paling high dan garansi imbal balik hasil besar bersama https://tiktok888.information/

togelsumo88 permainan paling high dan garansi imbal balik hasil besar bersama https://togelsumo88.com/

totosaja88 permainan paling high dan garansi imbal balik hasil besar bersama https://totosaja88.com/

trading88 permainan paling high dan garansi imbal balik hasil besar bersama https://trading88.org/

tradingview88 permainan paling high dan garansi imbal balik hasil besar bersama https://tradingview88.com/

tripadvisor88 permainan paling high dan garansi imbal balik hasil besar bersama https://tripadvisor88.com/

uang88 permainan paling high dan garansi imbal balik hasil besar bersama https://uang88.asia/

ubud88 permainan paling high dan garansi imbal balik hasil besar bersama https://ubud88.asia/

ultra77 permainan paling high dan garansi imbal balik hasil besar bersama https://ultra77.biz/

usdt88 permainan paling high dan garansi imbal balik hasil besar bersama https://usdt88.internet/

userslot88 permainan paling high dan garansi imbal balik hasil besar bersama https://userslot88.biz/

uyatoto permainan paling high dan garansi imbal balik hasil besar bersama https://uyatoto.com/

vegasslot88 permainan paling high dan garansi imbal balik hasil besar bersama https://vegasslot88.asia/

vertu777 permainan paling high dan garansi imbal balik hasil besar bersama https://vertu777.org/

voxy888 permainan paling high dan garansi imbal balik hasil besar bersama https://voxy888.biz/

warung22 permainan paling high dan garansi imbal balik hasil besar bersama https://warung22.com/

wasiat88 permainan paling high dan garansi imbal balik hasil besar bersama https://wasiat88.biz/

whatsapp88 permainan paling high dan garansi imbal balik hasil besar bersama https://whatsapp88.internet/

winrate999 permainan paling high dan garansi imbal balik hasil besar bersama https://winrate999.biz/

wks88 permainan paling high dan garansi imbal balik hasil besar bersama https://wks88.org/

wordpress88 permainan paling high dan garansi imbal balik hasil besar bersama https://wordpress88.internet/

wuzz888 permainan paling high dan garansi imbal balik hasil besar bersama https://wuzz888.com/

xuxu88 permainan paling high dan garansi imbal balik hasil besar bersama https://xuxu88.org/

yoktogel88 permainan paling high dan garansi imbal balik hasil besar bersama https://yoktogel88.slot.com/

zara88 permainan paling high dan garansi imbal balik hasil besar bersama https://zara88.slot.internet/

adu88 permainan paling high dan garansi imbal balik hasil besar bersama https://adu88.asia/

agoda88 permainan paling high dan garansi imbal balik hasil besar bersama https://agoda88.asia/

andara999 permainan paling high dan garansi imbal balik hasil besar bersama https://andara999.org/

asiahoki777 permainan paling high dan garansi imbal balik hasil besar bersama https://asiahoki777.asia/

asiahoki88 permainan paling high dan garansi imbal balik hasil besar bersama https://asiahoki88.org/

atlas777 permainan paling high dan garansi imbal balik hasil besar bersama https://atlas777.asia/

atlas88 permainan paling high dan garansi imbal balik hasil besar bersama https://atlas88.asia/

autospin888 permainan paling high dan garansi imbal balik hasil besar bersama https://autospin888.asia/

axl77 permainan paling high dan garansi imbal balik hasil besar bersama https://axl77.asia/

axl777 permainan paling high dan garansi imbal balik hasil besar bersama https://axl777.org/

ayo777 permainan paling high dan garansi imbal balik hasil besar bersama https://ayo777.stay/

bakwanbet88 permainan paling high dan garansi imbal balik hasil besar bersama https://bakwanbet88.com/

balak666 permainan paling high dan garansi imbal balik hasil besar bersama https://balak666.information/

bangkit88 permainan paling high dan garansi imbal balik hasil besar bersama https://bangkit88.biz/

batu88 permainan paling high dan garansi imbal balik hasil besar bersama https://batu88.biz/

bayar777 permainan paling high dan garansi imbal balik hasil besar bersama https://bayar777.asia/

bayar777 permainan paling high dan garansi imbal balik hasil besar bersama https://bayar777.stay/

bayar88 permainan paling high dan garansi imbal balik hasil besar bersama https://bayar88.asia/

berita88 permainan paling high dan garansi imbal balik hasil besar bersama https://berita88.biz/

bobo88 permainan paling high dan garansi imbal balik hasil besar bersama https://bobo88.asia/

box77 permainan paling high dan garansi imbal balik hasil besar bersama https://box77.asia/

bromo777 permainan paling high dan garansi imbal balik hasil besar bersama https://bromo777.stay/

ceria88 permainan paling high dan garansi imbal balik hasil besar bersama https://ceria88.biz/

cipit888 permainan paling high dan garansi imbal balik hasil besar bersama https://cipit888.asia/

dewahoki88 permainan paling high dan garansi imbal balik hasil besar bersama https://dewahoki88.asia/

dewanaga permainan paling high dan garansi imbal balik hasil besar bersama https://dewanaga.professional/

dewanaga88 permainan paling high dan garansi imbal balik hasil besar bersama https://dewanaga88.stay/

dewaslot77 permainan paling high dan garansi imbal balik hasil besar bersama https://dewaslot77.asia/

dewi228 permainan paling high dan garansi imbal balik hasil besar bersama https://dewi228.information/

dewihoki88 permainan paling high dan garansi imbal balik hasil besar bersama https://dewihoki88.asia/

dosen88 permainan paling high dan garansi imbal balik hasil besar bersama https://dosen88.org/

elanggame88 permainan paling high dan garansi imbal balik hasil besar bersama https://elanggame88.org/

slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun demo slot gacor permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun demo slot pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun slot demo pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun slot demo permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun demo slot permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

slot demo gacor

akun demo slot gacor

akun slot demo gacor

akun demo slot pragmatic

akun slot demo pragmatic

akun slot demo

akun demo slot

slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun demo slot gacor permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun demo slot pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun slot demo pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun slot demo permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun demo slot permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

slot demo gacor

akun demo slot gacor

akun slot demo gacor

akun demo slot pragmatic

akun slot demo pragmatic

akun slot demo

akun demo slot

slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun demo slot gacor permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun demo slot pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun slot demo pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun slot demo permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun demo slot permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

slot demo gacor

akun demo slot gacor

akun slot demo gacor

akun demo slot pragmatic

akun slot demo pragmatic

akun slot demo

akun demo slot

slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun demo slot gacor permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun demo slot pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun slot demo pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun slot demo permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun demo slot permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

slot demo gacor

akun demo slot gacor

akun slot demo gacor

akun demo slot pragmatic

akun slot demo pragmatic

akun slot demo

akun demo slot

situs slot terbaru

slot terbaru