privetik

Pricey Fellow Shareholders,

Annualized

Third Ave Actual Property Worth Fund (Inst. Class)

3Mo

1Yr

3Yr

5Yr

10Yr

Inception

Inception Date

0.47%

14.37%

1.17%

4.41%

4.13%

8.86%

9/17/1998

Third Ave Actual Property Worth Fund (Inv. Class)

0.42%

14.12%

0.93%

4.15%

3.87%

6.78%

12/31/2009

Third Ave Actual Property Worth Fund (Z Class)

0.48%

14.47%

1.28%

4.51%

N/A

3.38%

3/1/2018

Click on to enlarge

We’re happy to give you the Third Avenue Actual Property Worth Fund’s (MUTF:TVRVX, the “Fund”) report for the quarter ended December 31, 2024. For the newest calendar yr, the Fund generated a return of +14.37% (after charges) versus +2.00% (earlier than charges) for the Fund’s most-relevant benchmark, the FTSE EPRA NAREIT Developed Index¹.

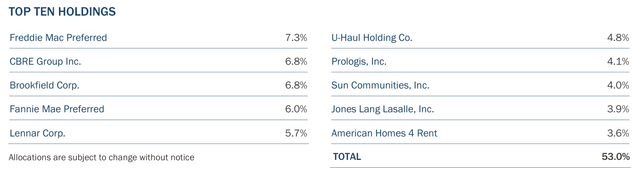

The first contributors to efficiency throughout the quarter included the Fund’s investments in (i) the popular fairness of Fannie Mae (OTCQB:FNMA) and Freddie Mac and (ii) the widespread inventory of sure actual property working corporations (CBRE Group and Brookfield Company). Nevertheless, these positive factors had been partially offset by detractors throughout the interval, together with the Fund’s investments in companies tied to residential development (Lennar Corp., D.R. Horton, and Weyerhaeuser) and varied U.Ok.primarily based corporations (Large Yellow, Segro plc, and Berkeley Group). Additional insights into these positions, portfolio allocations, and the Fund’s additions to pick worldwide holdings (i.e., Berkeley Group, Large Yellow, and Accor SA) are included herein.

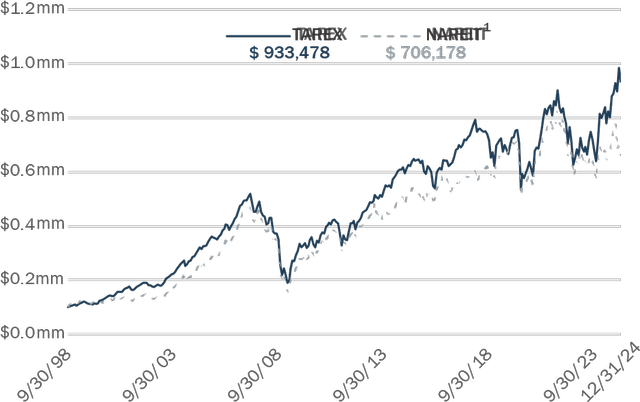

However current efficiency, Fund Administration considers the technique’s long-term outcomes as probably the most related scorecard. To that finish, the Fund has generated an annualized return of +8.86% (after charges) since its inception greater than twenty-six years in the past. Because of this, this efficiency signifies that an preliminary funding of $100,000 within the Fund would have a market worth exceeding $930,000 (assuming distributions had been reinvested), or greater than the identical $100,000 could be value had it been positioned right into a passive mutual fund monitoring the Fund’s most-relevant benchmark over the identical time-period.

VALUE OF $100,000 SINCE SEPTEMBER 1998: As of December 31, 2024

Hypothetical Funding since September 30, 1998 (Fund Inception Date September 17, 1998). Previous efficiency doesn’t assure future efficiency outcomes.

Exercise

Within the Anatomy of the Bear: Classes from Wall Road’s 4 Nice Bottoms, the ever-astute creator Russell Napier research 4 of probably the most important “bear markets” in U.S. equities over the previous century and sheds perspective on what led to those market disruptions. He additionally identifies “signals” that these stretches had been close to the top, thus paving the best way for a few of the “best returns” over the previous 100 years.

As Napier illustrates, every interval was usually idiosyncratic in nature. Nevertheless, there have been unifying components with every event (i) preceded by overextended valuations when considered via a basic lens and (ii) adopted by a prolonged adjustment interval as valuations declined for almost a decade thereafter, on common. As well as, all 4 of the intervals studied shared indicators that the “correction” was certainly ending, together with: (i) extremely “cheap equity prices”, which Napier measured by the “q-Ratio” (i.e., a measure of the inventory market valuation relative to the substitute price of its belongings, much like tangible guide worth) and (ii) low buying and selling volumes, that subsequently elevated alongside inventory costs regardless of “continued declines in reported corporate earnings”.

Whereas such findings should not straight associated to actual property securities per se, Fund Administration believes two major ideas are related to the present market surroundings, in addition to Third Avenue’s strategy to investing in widespread shares extra usually, together with:

Diverging Valuations: It’s broadly reported that almost all “broad based” fairness indices are buying and selling at above-average price-to-earnings (“P/E”) multiples inside a historic context, significantly with the increasing focus of the “Magnificent 7” in such composites. What appears much less reported although, in our view, is that sure sub-sets of those indices have diverged considerably lately. As an illustration, the MSCI USA Index (which tracks the midand-large cap segments of the U.S. fairness markets) at present trades at a price-to-book a number of of 5.2 occasions— greater than 50% above the long-term common and a degree that has solely been exceeded in a single different occasion prior to now 30 years (i.e., Q1 2000). Then again, distinct sub-sets of worldwide equities stay rather more modestly valued and under long-term averages, similar to Listed Actual Property (as measured by the MSCI ACWI Core Actual Property Index) and Worldwide Equities (as measured by the MSCI EAFE Index), which at present commerce at price-to-book multiples of 1.3 occasions and 1.8 occasions, respectively. Fundamentals over Technicals: Regardless of Napier figuring out sure “signals” that are likely to precede a restoration in fairness costs after market bouts, Fund Administration doesn’t imagine it’s attainable to “pick market bottoms” with precision (e.g., March 2009). In lieu of such an endeavor, the Actual Property Worth Fund concentrates its widespread inventory investments in enterprises that aren’t solely buying and selling at reductions to Internet-Asset Worth (“NAV”), however ones which are additionally remarkably well-capitalized and run by aligned management teams. Whereas such a tradeoff could go away the Fund establishing positions in securities that “drift lower” within the near-term, it has been our expertise that well-established actual property platforms are prone to show extra sturdy in worth over the long-term.

Alongside these strains, the Fund elevated its allocation to a area inside Listed Actual Property that has diverged sharply from a basic valuation standpoint extra just lately: the U.Ok. & Europe. Fund Administration acknowledges the varied currents on the political, social, and financial entrance in these markets. Nevertheless, the price-to-value hole for a number of issuers appears to compensate for such gadgets, in our opinion, and led to the Fund growing sure holdings within the quarter, together with: Berkeley Group (OTCPK:BKGFY), Large Yellow (OTCPK:BYLOF), and Accor SA (OTCPK:ACRFF).

The Berkeley Group Holdings PLC (“Berkeley”) is a U.Ok.-based actual property working firm targeted on residential-led regeneration tasks in London and Southeast England. It is usually one of many premier actual property platforms globally, in our view, as Berkeley is (i) extraordinarily well-capitalized with a netcash place and an unequalled land financial institution with planning for greater than 50,000 houses in exceptionally supply-constrained markets, (ii) very well-managed by a crew that not solely owns important inventory however has a superb capital allocation monitor file, and (iii) compounding its company net-worth by greater than 10% per yr, on common, via environment friendly operations the place it accounts for almost 1 out of each 10 new houses in-built London.

As well as, Berkeley’s widespread inventory traded at lower than 10 occasions earnings by Fund Administration’s estimates and a priceto-book a number of of 1.1 occasions—basically the bottom implied ratio prior to now 15 years. However, Fund Administration expects that Berkeley widespread will commerce again in-line with its “run-off value” on the very least as rate of interest (and mortgage charge) volatility within the U.Ok. subsides. Within the meantime, the corporate is unlocking extra worth by forming a privaterental or “PRS” platform in addition to returning capital to shareholders via accretive share repurchases and particular dividends.

On the identical time although, Large Yellow’s widespread inventory traded at costs that implied a 7.5% “capitalization rate” at quarter-end (or the unlevered yield on the actual property belongings) with out factoring in any worth for the additional lease-up of the in-place portfolio regardless of a emptiness charge of almost 20%. The shares additionally commerce at a price-tobook a number of of roughly 0.7 occasions—the bottom degree in additional than a decade. With this being the case, Fund Administration expects the price-to-value hole to slim as Large Yellow continues to execute on its measured growth and fundamentals stabilize. If not, Large Yellow might very properly get wrapped up into trade consolidation the place non-public market transactions have implied considerably decrease cap charges (and thus considerably larger asset values) extra just lately.

Accor SA (“Accor”) is a France-based lodge administration and franchise firm with a world hospitality platform that contains almost 5,000 resorts and 850,000 rooms— roughly 95% of that are in Europe, the Center East, Asia Pacific, and South America. In Fund Administration’s opinion, the corporate can be one of many few “safe and cheap” alternatives within the lodging area as Accor is (i) wellcapitalized with the biggest y platform exterior of North America, which can be money generative and modestly encumbered, (ii) run by an aligned management group together with a educated and engaged shareholder base, and (iii) actively creating worth by monetizing owned actual property and redirecting capital to additional increasing its “management and franchise” enterprise, significantly exterior of North America the place the shift to such platforms is accelerating.

However this progress, Accor’s widespread inventory appears to stay at a significant low cost to its NAV and world friends. Put in any other case, when one accounts for the worth of the corporate’s investments in sure partially owned belongings (i.e., AccorInvest), the implied worth for the remaining administration and franchise platform is roughly 13 occasions money stream by our estimates, greater than a 40% low cost to its world friends. Subsequently, Fund Administration believes Accor’s price of capital will enhance because it completes the transition to an “asset light” world hospitality platform. If not, it will not be inconceivable to see the corporate have interaction in useful resource conversion by combining its enterprise (or one among its segments) with different trade individuals to floor worth.

Outdoors of those additions, the Fund additionally trimmed again varied positions for portfolio administration functions, together with: CBRE Group (CBRE), Brookfield Corp. (BAM), Fannie Mae, and Freddie Mac. Fund Administration stays constructive on every holding nonetheless, and would be aware current developments at Fannie Mae and Freddie Mac (collectively the “GSEs”) as significantly supportive of the crew’s long-held funding thesis. That’s to say, the GSEs appear to be shifting nearer to exiting “conservatorship” having gathered almost $150 billion of “net-worth”, with the potential for that timeline to be accelerated as contemplated by the Congressional Price range Workplace on this December 2024 Report: An Replace to CBO’s Evaluation of the Results of Recapitalizing Fannie Mae and Freddie Mac Via Administrative Actions.

As well as, the Fund (i) acquired a particular dividend from Timber REIT Rayonier Inc. (RYN) and (ii) prolonged out hedges referring to sure international foreign money exposures (i.e., British Pound) throughout the interval. Additionally of be aware: the Fund’s long-time holding Lennar Corp. (LEN, a U.S. homebuilder) finalized plans to “split off” its land growth enterprise (“Millrose Properties”), with the transaction to be effectuated in mid-January. Fund Administration believes the separation will floor incremental worth for Lennar Corp. as a “net cash” and “land light” builder following the deal and plans to share additional particulars within the subsequent Shareholder Letter.

POSITIONING

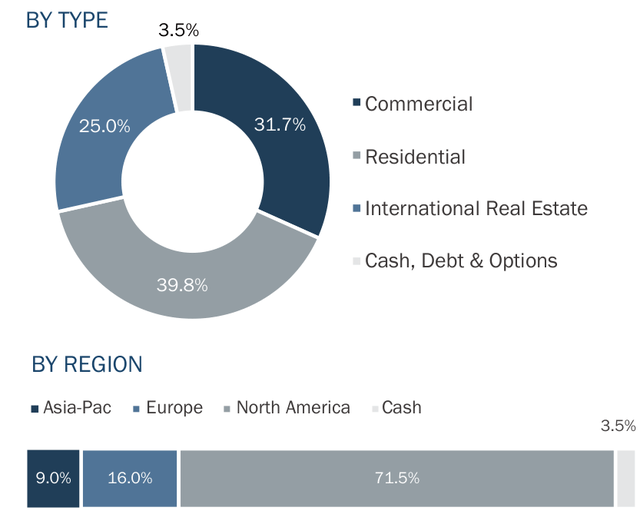

After incorporating this exercise, the Fund had roughly 39.8% of its capital invested in U.S.-based corporations targeted on Residential Actual Property, together with these concerned with: Entry-Degree Homebuilding (Lennar Corp. and D.R. Horton); Workforce Housing (AMH and Solar Communities); Land and Timber (Rayonier, Weyerhaeuser, and 5 Level); and Mortgage and Title Insurance coverage (Fannie Mae, Freddie Mac, and Constancy Nationwide Monetary). In Fund Administration’s view, every one among these enterprises has a well-established place in its respective section of the residential worth chain. As well as, these holdings appear poised to learn from favorable basic drivers inside the U.S. residential markets over time, together with: (i) close to file low ranges of for-sale inventories, (ii) close to file excessive demand for reasonably priced for-sale and rental choices, and (iii) price pressures leaving more-efficient trade individuals taking additional market share.

The Fund additionally had 31.7% of its capital invested in North American-based corporations concerned with choose pockets of Industrial Actual Property, together with: Actual Property Companies (CBRE Group and JLL); Asset Administration (Brookfield Corp. and Brookfield Asset Mgmt.); Industrial and Logistics (Prologis, First Industrial, and Wesco); and Self-Storage (U-Haul Holdings). In Fund Administration’s opinion, these holdings signify platforms that may be very tough to reassemble. Additionally they comprise areas of business actual property that appear to favor long-term traders. Put in any other case, these enterprises focus on both (i) property varieties with structural demand drivers and restricted “maintenance capex” or (ii) actual property companies which are usually much less “capital intensive” with a concentrate on brokerage, property administration, and different advisory actions that may provide “higher returns on invested capital” over time.

An extra 25.0% of the Fund’s capital is invested in Worldwide Actual Property corporations. These companies are largely targeted on the identical sorts of residential and business actions as outlined above, merely with main platforms of their respective areas. On the finish of the quarter these investments included issuers concerned with: Industrial Actual Property (CK Asset, Large Yellow, Nationwide Storage, Wharf and Segro); Residential Actual Property (Berkeley, Grainger, and Ingenia); and Actual Property Companies (Savills and Accor). The holdings are additionally listed in developed markets the place Fund Administration believes there are (i) satisfactory disclosures and securities legal guidelines in addition to (ii) ample alternatives for useful resource conversion and alter of management transactions (e.g., the U.Ok., Australia, France, and Hong Kong).

The remaining 3.5% of the Fund’s capital is in Money, Debt & Choices. These holdings embody U.S.-Greenback primarily based money and equivalents, short-term U.S. Treasuries, and hedges referring to sure international foreign money exposures (i.e., Hong Kong Greenback and British Pound).

The Fund’s allocations throughout these varied segments are outlined within the chart under, together with the publicity by geography (North America, Europe, and Asia-Pacific). As well as, the holdings proceed to signify “durable value” in Fund Administration’s opinion. That’s to say, the fairness holdings are very properly capitalized (in our view) with a mean loan-to-value ratio of 14% on the finish of the interval. Additional, the low cost to NAV for the Fund’s holdings expanded to twenty.9% at quarter-end when considered within the combination.

ASSET ALLOCATION As of December 31, 2024 | Supply: Firm Studies, Bloomberg

FUND COMMENTARY

FUND COMMENTARY

Throughout the quarter, the Federal Reserve Financial institution of Cleveland printed an financial commentary titled New-Tenant Hire Passthrough and the Way forward for Hire Inflation. Whereas actually not an “attention getting” headline in most circles, the evaluation had vital implications in Fund Administration’s view. Most significantly, the co-authors noticed that within the U.S. the “year-over-year consumer price index (CPI) inflation rate—excluding shelter—is below 2.0%” whereas the “year-over-year CPI shelter inflation rate is 4.8% and the largest component of CPI inflation with a weight of about 32%”.

The co-authors additionally famous the “year-over-year figures” for shelter haven’t correlated to different broadly adopted benchmarks monitoring rental charges nationwide. As a substitute, the coauthors concluded this disconnect was as a result of “CPI figure placing a larger weight on existing tenants” versus “new move-in rates”. Notably, in addition they estimated {that a} almost 5.5% hole between in-place rents and market rents remained for present tenants. Because of this, the evaluation concluded that “CPI rent inflation will remain above its prepandemic norm of about 3.5% until mid-2026”.

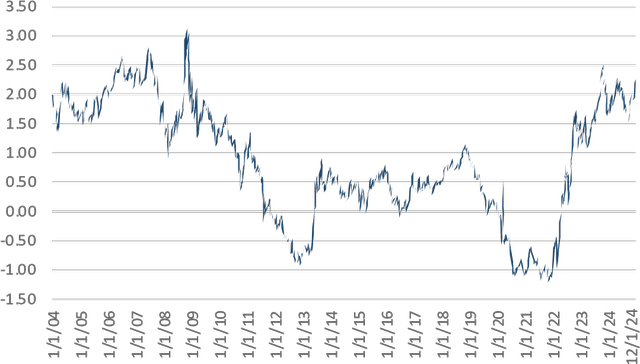

On the identical time, traders in long-dated U.S. Treasury Notes (e.g., 10-12 months and 30-12 months Notes) skilled one other yr of “mark-to-market” losses in 2024. In actual fact, this represents the fourth time prior to now 5 years that such an end result has transpired. Consequently, it seems as if fixed-income traders have begun to demand structurally larger “real rates of return”, or a larger return premium over the prevailing inflation charge. For perspective, the chart under illustrates that the “real rate of return” for 10-12 months U.S. Treasury Notes (US10Y) exceeded 2.0% on the finish of 2024—a degree that’s properly above these provided within the decade following the “global financial crisis”.

10-12 months U.S. Treasuries: Actual Charges of Return As of December 31, 2024 | Supply: Federal Reserve

When the potential for larger charges of CPI as famous by the Cleveland Fed is considered together with the seeming reset in “real rates”, it isn’t inconceivable to count on that nominal yields for U.S. Treasuries (i.e., the sum of the actual charge and the inflation charge) will stay extra elevated within the interval forward. Subsequently, Fund Administration believes that three components will stay paramount for producing differentiated leads to Listed Actual Property, together with a concentrate on holdings that exhibit:

Monetary Power: In our expertise, well-financed companies cannot solely navigate via tougher markets, thus preserving worth, however are additionally positioned to make value-enhancing investments when capital is scarce. In different phrases, the Fund targets actual property companies with tremendous robust monetary positions. In actual fact, on the finish of the yr the Debt to Asset Ratio for the Fund’s holdings was 40% lower than these of the constituents comprising the biggest Actual Property Mutual Fund: the Vanguard Actual Property Index Fund (VGSNX). As well as, the Fund’s holdings appear much less dependent upon capital markets to finance capital allocation priorities. That is largely as a result of Third Avenue Actual Property Worth Fund being targeted on enterprises that may retain money stream to reinvest within the enterprise with greater than 70% of the portfolio structured as Actual Property Working Firms (“REOCs”) versus REITs (that are required to distribute a lot of the money stream as dividends). Sturdy Worth: Actual Property stays a contrarian allocation with generalist traders nonetheless “underweight” the sector per BofA Analysis. Not a coincidence, Listed Actual Property appears to commerce at extra favorable valuations with the Worth to Funds from Operations (“FFO” or a Actual Property measure of money stream) for U.S. REITs at 19 occasions per Citigroup analysis—greater than a 30% low cost to the P/E ratio for broader U.S. equites as measured by the MSCI US Index. Such a disconnect is uncommon. Nevertheless, balanced observers would level out that REITs face varied headwinds, together with the necessity to refinance debt at larger charges, which is prone to offset “top line” development in lots of situations. Instead, the Actual Property Worth Fund’s holdings not solely commerce at a reduction on money stream metrics, but additionally conservative estimates of NAV. The Fund’s holdings additionally traded a price-to-book ratio of 1.3 occasions at quarter-end, in comparison with the VGSNX at 2.4 occasions on the identical date. Prospects to Enhance NAV: Third Avenue’s Founder Marty Whitman as soon as stated, “If the NAV isn’t growing, the NAV is wrong”—which we imagine he would agree is much more so the case in the next “real rate” surroundings. Inside that framework, the opposite unifying theme behind the Fund’s investments throughout the Residential, Industrial, and Worldwide Actual Property segments is that the holdings function in actual property sectors that appear to be structurally supported with (i) favorable supply-and-demand dynamics or (ii) trade forces that favor additional consolidation. Because of this, the select-set of issuers held within the Actual Property Worth Fund appear to exhibit “pricing power” or distinct “operating leverage”, leaving them much less dependent upon nominal inflation (or detrimental actual charges) to extend revenues (and income) in our evaluation.

Fund Administration acknowledges an emphasis on these components won’t seemingly show to be the optimum technique ought to a interval of “negative real rates” resurface (i.e., when important leverage tends to be rewarded). Nevertheless, a concentrate on (i) wellcapitalized companies, (ii) with discounted safety costs, and (iii) prospects for additional wealth creation is a mixture that has at all times made sense at Third Avenue. It is usually a technique that appears significantly well-suited for these searching for out “Real Returns” in Listed Actual Property within the interval forward.

Sincerely,

The Third Avenue Actual Property Worth Group

This publication doesn’t represent a suggestion or solicitation of any transaction in any securities. Any advice contained herein is probably not appropriate for all traders. Info contained on this publication has been obtained from sources we imagine to be dependable, however can’t be assured.

The knowledge on this portfolio supervisor letter represents the opinions of the portfolio supervisor(s) and isn’t supposed to be a forecast of future occasions, a assure of future outcomes or funding recommendation. Views expressed are these of the portfolio supervisor(s) and should differ from these of different portfolio managers or of the agency as an entire. Additionally, please be aware that any dialogue of the Fund’s holdings, the Fund’s efficiency, and the portfolio supervisor(s) views are as of December 31, 2024 (besides as in any other case acknowledged), and are topic to alter with out discover. Sure data contained on this letter constitutes “forwardlooking statements,” which may be recognized by means of forward-looking terminology similar to “may,” “will,” “should,” “expect,” “anticipate,” “project,”

“estimate,” “intend,” “continue” or “believe,” or the negatives thereof (similar to “may not,” “should not,” “are not expected to,” and so on.) or different variations thereon or comparable terminology. Attributable to varied dangers and uncertainties, precise occasions or outcomes or the precise efficiency of any fund could differ materially from these mirrored or contemplated in any such forward-looking assertion. Present efficiency outcomes could also be decrease or larger than efficiency numbers quoted in sure letters to shareholders.

Date of first use of portfolio supervisor commentary: January 15, 2025

1 The FTSE EPRA/NAREIT Developed Actual Property Index was developed by the European Public Actual Property Affiliation (EPRA), a typical curiosity group aiming to advertise, develop and signify the European public actual property sector, and the North American Affiliation of Actual Property Funding Trusts (NAREIT), the consultant voice of the US REIT trade. The index sequence is designed to replicate the inventory efficiency of corporations engaged in particular facets of the North American, European and Asian Actual Property markets. The Index is capitalization-weighted. The index is just not a safety that may be bought or offered.

For the Third Avenue Glossary please go to right here. Allocations are topic to alter with out discover

Previous efficiency is not any assure of future outcomes; returns embody reinvestment of all distributions. The above represents previous efficiency and present efficiency could also be decrease or larger than efficiency quoted above. Funding return and principal worth fluctuate in order that an investor’s shares, when redeemed, could also be value roughly than the unique price. For the newest month-end efficiency, please go to the Fund’s web site at Third Avenue Administration | Pioneers in Worth Investing Since 1986. The gross expense ratio for the Fund’s Institutional, Investor and Z share lessons is 1.19%, 1.45% and 1.11%, respectively, as of March 1, 2024.

Distributions and yields are topic to alter and should not assured.

Dangers that might negatively impression returns embody: overbuilding and elevated competitors, will increase in property taxes and working bills, lack of financing, vacancies, environmental contamination and its associated clean-up, modifications in rates of interest, casualty or condemnation losses, and variations in rental revenue.

The fund’s funding goals, dangers, fees, and bills have to be thought of rigorously earlier than investing. The prospectus comprises this and different vital details about the funding firm, and it might be obtained by calling 800-443-1021 or visiting Third Avenue Administration | Pioneers in Worth Investing Since 1986. Learn it rigorously earlier than investing.

Distributor of Third Avenue Funds: Foreside Fund Companies, LLC.

Present efficiency outcomes could also be decrease or larger than efficiency numbers quoted in sure letters to shareholders.

Third Avenue presents a number of funding options with distinctive exposures and return profiles. Our core methods are at present out there via ’40Act mutual funds and customised accounts. If you want additional data, please contact a Relationship Supervisor.

Efficiency is proven for the Third Avenue Actual Property Worth Fund (Institutional Class). Previous efficiency is not any assure of future outcomes; returns embody reinvestment of all distributions. Previous efficiency and present efficiency could also be decrease or larger than efficiency quoted above. Funding return and principal worth fluctuate in order that an investor’s shares, when redeemed, could also be value roughly than the unique price. For the newest month-end efficiency, please go to the Fund’s web site at Third Avenue Administration | Pioneers in Worth Investing Since 1986.

The U.S. Lipper Fund Award for Greatest Fairness Small Fund Household is predicated on a assessment of 185 certified fund administration corporations that had been eligible for the three-year interval ending on 11/30/23. To qualify for Lipper’s Total Small Fund Household Group Award, Small fund household teams will need to have at the very least three fairness portfolios. The group award shall be given to the group with the bottom common decile rating of its respective asset class outcomes primarily based on the three-year Constant Return measure of the eligible funds.

From LSEG Lipper Fund Award© 2024 LSEG. All rights reserved. Used below license.

Click on to enlarge

Unique Publish

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

Enterprise

ADVERTISEMENT

Informasi mengenai king slot

king selot

king slot

king slot

kingselot

pg king slot

rungkad88

sabet88slot

sakti888

santai88

santika88

sebat777

sebat88

sensasi77

serba88

shangrila88

sheraton88

shopee88

sibukslot88

sido888

sinar88slot

sinartogel88

singa88

sis88

slotplay88

solitaire88

sontogel88

sparta888

speaker88

suara88

sukaslot888

sultan777

sumo7777

supermoney888

surga888

surgaplay88

surya888

suzuki88

tahta88

tahtatoto

target888

taruhan777

tato88

tebar88

teknis88

teluk88

teluk88

texas888

kilau88

tiket88

tiktok888

togelsumo88

totosaja88

trading88

tradingview88

tripadvisor88

uang88

ubud88

ultra77

usdt88

userslot88

uyatoto

vegasslot88

vertu777

voxy888

warung22

wasiat88

whatsapp88

winrate999

wks88

wordpress88

wuzz888

xuxu88

yoktogel88

zara88

adu88

agoda88

andara999

asiahoki777

asiahoki88

atlas777

atlas88

autospin888

axl77

axl777

ayo777

bakwanbet88

balak666

bangkit88

batu88

bayar777

bayar777

bayar88

berita88

bobo88

box77

bromo777

ceria88

cipit888

dewahoki88

dewanaga

dewanaga88

dewaslot77

dewi228

dewihoki88

dosen88

elanggame88

rungkad88 permainan paling high dan garansi imbal balik hasil besar bersama https://rungkad88.biz/

sabet88slot permainan paling high dan garansi imbal balik hasil besar bersama https://sabet88slot.com/

sakti888 permainan paling high dan garansi imbal balik hasil besar bersama https://sakti888.biz/

santai88 permainan paling high dan garansi imbal balik hasil besar bersama https://santai88.org/

santika88 permainan paling high dan garansi imbal balik hasil besar bersama https://santika88.org/

sebat777 permainan paling high dan garansi imbal balik hasil besar bersama https://sebat777.information/

sebat88 permainan paling high dan garansi imbal balik hasil besar bersama https://sebat88.information/

sensasi77 permainan paling high dan garansi imbal balik hasil besar bersama https://sensasi77.biz/

serba88 permainan paling high dan garansi imbal balik hasil besar bersama https://serba88.biz/

shangrila88 permainan paling high dan garansi imbal balik hasil besar bersama https://shangrila88.com/

sheraton88 permainan paling high dan garansi imbal balik hasil besar bersama https://sheraton88.com/

shopee88 permainan paling high dan garansi imbal balik hasil besar bersama https://shopee88.biz/

sibukslot88 permainan paling high dan garansi imbal balik hasil besar bersama https://sibukslot88.com/

sido888 permainan paling high dan garansi imbal balik hasil besar bersama https://sido888.com/

sinar88slot permainan paling high dan garansi imbal balik hasil besar bersama https://sinar88slot.information/

sinartogel88 permainan paling high dan garansi imbal balik hasil besar bersama https://sinartogel88.biz/

singa88 permainan paling high dan garansi imbal balik hasil besar bersama https://singa88.biz/

sis88 permainan paling high dan garansi imbal balik hasil besar bersama https://sis88.biz/

slotplay88 permainan paling high dan garansi imbal balik hasil besar bersama https://slotplay88.biz/

solitaire88 permainan paling high dan garansi imbal balik hasil besar bersama https://solitaire88.internet/

sontogel88 permainan paling high dan garansi imbal balik hasil besar bersama https://sontogel88.com/

sparta888 permainan paling high dan garansi imbal balik hasil besar bersama https://sparta888.co/

speaker88 permainan paling high dan garansi imbal balik hasil besar bersama https://speaker88.internet/

suara88 permainan paling high dan garansi imbal balik hasil besar bersama https://suara88.biz/

sukaslot888 permainan paling high dan garansi imbal balik hasil besar bersama https://sukaslot888.information/

sultan777 permainan paling high dan garansi imbal balik hasil besar bersama https://sultan777.asia/

sumo7777 permainan paling high dan garansi imbal balik hasil besar bersama https://sumo7777.com/

supermoney888 permainan paling high dan garansi imbal balik hasil besar bersama https://supermoney888.biz/

surga888 permainan paling high dan garansi imbal balik hasil besar bersama https://surga888.biz/

surgaplay88 permainan paling high dan garansi imbal balik hasil besar bersama https://surgaplay88.biz/

surya888 permainan paling high dan garansi imbal balik hasil besar bersama https://surya888.biz/

suzuki88 permainan paling high dan garansi imbal balik hasil besar bersama https://suzuki88.biz/

tahta88 permainan paling high dan garansi imbal balik hasil besar bersama https://tahta88.biz/

tahtatoto permainan paling high dan garansi imbal balik hasil besar bersama https://tahtatoto.biz/

target888 permainan paling high dan garansi imbal balik hasil besar bersama https://target888.biz/

taruhan777 permainan paling high dan garansi imbal balik hasil besar bersama https://taruhan777.biz/

tato88 permainan paling high dan garansi imbal balik hasil besar bersama https://tato88.org/

tebar88 permainan paling high dan garansi imbal balik hasil besar bersama https://tebar88.asia/

teknis88 permainan paling high dan garansi imbal balik hasil besar bersama https://teknis88.com/

teluk88 permainan paling high dan garansi imbal balik hasil besar bersama https://teluk88.biz/

teluk88 permainan paling high dan garansi imbal balik hasil besar bersama https://teluk88.information/

texas888 permainan paling high dan garansi imbal balik hasil besar bersama https://texas888.asia/

kilau88 permainan paling high dan garansi imbal balik hasil besar bersama https://texas888slot.org/

tiket88 permainan paling high dan garansi imbal balik hasil besar bersama https://tiket88.asia/

tiktok888 permainan paling high dan garansi imbal balik hasil besar bersama https://tiktok888.information/

togelsumo88 permainan paling high dan garansi imbal balik hasil besar bersama https://togelsumo88.com/

totosaja88 permainan paling high dan garansi imbal balik hasil besar bersama https://totosaja88.com/

trading88 permainan paling high dan garansi imbal balik hasil besar bersama https://trading88.org/

tradingview88 permainan paling high dan garansi imbal balik hasil besar bersama https://tradingview88.com/

tripadvisor88 permainan paling high dan garansi imbal balik hasil besar bersama https://tripadvisor88.com/

uang88 permainan paling high dan garansi imbal balik hasil besar bersama https://uang88.asia/

ubud88 permainan paling high dan garansi imbal balik hasil besar bersama https://ubud88.asia/

ultra77 permainan paling high dan garansi imbal balik hasil besar bersama https://ultra77.biz/

usdt88 permainan paling high dan garansi imbal balik hasil besar bersama https://usdt88.internet/

userslot88 permainan paling high dan garansi imbal balik hasil besar bersama https://userslot88.biz/

uyatoto permainan paling high dan garansi imbal balik hasil besar bersama https://uyatoto.com/

vegasslot88 permainan paling high dan garansi imbal balik hasil besar bersama https://vegasslot88.asia/

vertu777 permainan paling high dan garansi imbal balik hasil besar bersama https://vertu777.org/

voxy888 permainan paling high dan garansi imbal balik hasil besar bersama https://voxy888.biz/

warung22 permainan paling high dan garansi imbal balik hasil besar bersama https://warung22.com/

wasiat88 permainan paling high dan garansi imbal balik hasil besar bersama https://wasiat88.biz/

whatsapp88 permainan paling high dan garansi imbal balik hasil besar bersama https://whatsapp88.internet/

winrate999 permainan paling high dan garansi imbal balik hasil besar bersama https://winrate999.biz/

wks88 permainan paling high dan garansi imbal balik hasil besar bersama https://wks88.org/

wordpress88 permainan paling high dan garansi imbal balik hasil besar bersama https://wordpress88.internet/

wuzz888 permainan paling high dan garansi imbal balik hasil besar bersama https://wuzz888.com/

xuxu88 permainan paling high dan garansi imbal balik hasil besar bersama https://xuxu88.org/

yoktogel88 permainan paling high dan garansi imbal balik hasil besar bersama https://yoktogel88.slot.com/

zara88 permainan paling high dan garansi imbal balik hasil besar bersama https://zara88.slot.internet/

adu88 permainan paling high dan garansi imbal balik hasil besar bersama https://adu88.asia/

agoda88 permainan paling high dan garansi imbal balik hasil besar bersama https://agoda88.asia/

andara999 permainan paling high dan garansi imbal balik hasil besar bersama https://andara999.org/

asiahoki777 permainan paling high dan garansi imbal balik hasil besar bersama https://asiahoki777.asia/

asiahoki88 permainan paling high dan garansi imbal balik hasil besar bersama https://asiahoki88.org/

atlas777 permainan paling high dan garansi imbal balik hasil besar bersama https://atlas777.asia/

atlas88 permainan paling high dan garansi imbal balik hasil besar bersama https://atlas88.asia/

autospin888 permainan paling high dan garansi imbal balik hasil besar bersama https://autospin888.asia/

axl77 permainan paling high dan garansi imbal balik hasil besar bersama https://axl77.asia/

axl777 permainan paling high dan garansi imbal balik hasil besar bersama https://axl777.org/

ayo777 permainan paling high dan garansi imbal balik hasil besar bersama https://ayo777.dwell/

bakwanbet88 permainan paling high dan garansi imbal balik hasil besar bersama https://bakwanbet88.com/

balak666 permainan paling high dan garansi imbal balik hasil besar bersama https://balak666.information/

bangkit88 permainan paling high dan garansi imbal balik hasil besar bersama https://bangkit88.biz/

batu88 permainan paling high dan garansi imbal balik hasil besar bersama https://batu88.biz/

bayar777 permainan paling high dan garansi imbal balik hasil besar bersama https://bayar777.asia/

bayar777 permainan paling high dan garansi imbal balik hasil besar bersama https://bayar777.dwell/

bayar88 permainan paling high dan garansi imbal balik hasil besar bersama https://bayar88.asia/

berita88 permainan paling high dan garansi imbal balik hasil besar bersama https://berita88.biz/

bobo88 permainan paling high dan garansi imbal balik hasil besar bersama https://bobo88.asia/

box77 permainan paling high dan garansi imbal balik hasil besar bersama https://box77.asia/

bromo777 permainan paling high dan garansi imbal balik hasil besar bersama https://bromo777.dwell/

ceria88 permainan paling high dan garansi imbal balik hasil besar bersama https://ceria88.biz/

cipit888 permainan paling high dan garansi imbal balik hasil besar bersama https://cipit888.asia/

dewahoki88 permainan paling high dan garansi imbal balik hasil besar bersama https://dewahoki88.asia/

dewanaga permainan paling high dan garansi imbal balik hasil besar bersama https://dewanaga.professional/

dewanaga88 permainan paling high dan garansi imbal balik hasil besar bersama https://dewanaga88.dwell/

dewaslot77 permainan paling high dan garansi imbal balik hasil besar bersama https://dewaslot77.asia/

dewi228 permainan paling high dan garansi imbal balik hasil besar bersama https://dewi228.information/

dewihoki88 permainan paling high dan garansi imbal balik hasil besar bersama https://dewihoki88.asia/

dosen88 permainan paling high dan garansi imbal balik hasil besar bersama https://dosen88.org/

elanggame88 permainan paling high dan garansi imbal balik hasil besar bersama https://elanggame88.org/

slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun demo slot gacor permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun demo slot pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun slot demo pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun slot demo permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

akun demo slot permainan paling high dan garansi imbal balik hasil besar bersama https://kdwapp.com/

slot demo gacor

akun demo slot gacor

akun slot demo gacor

akun demo slot pragmatic

akun slot demo pragmatic

akun slot demo

akun demo slot

slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun demo slot gacor permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun demo slot pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun slot demo pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun slot demo permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

akun demo slot permainan paling high dan garansi imbal balik hasil besar bersama https://jebswagstore.com

slot demo gacor

akun demo slot gacor

akun slot demo gacor

akun demo slot pragmatic

akun slot demo pragmatic

akun slot demo

akun demo slot

slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun demo slot gacor permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun demo slot pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun slot demo pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun slot demo permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

akun demo slot permainan paling high dan garansi imbal balik hasil besar bersama https://demoslotgacor.professional

slot demo gacor

akun demo slot gacor

akun slot demo gacor

akun demo slot pragmatic

akun slot demo pragmatic

akun slot demo

akun demo slot

slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun demo slot gacor permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun slot demo gacor permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun demo slot pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun slot demo pragmatic permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun slot demo permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

akun demo slot permainan paling high dan garansi imbal balik hasil besar bersama https://situsslotterbaru.internet

slot demo gacor

akun demo slot gacor

akun slot demo gacor

akun demo slot pragmatic

akun slot demo pragmatic

akun slot demo

akun demo slot

situs slot terbaru

slot terbaru